About CFP® Certification

Global Excellence in Financial Planning

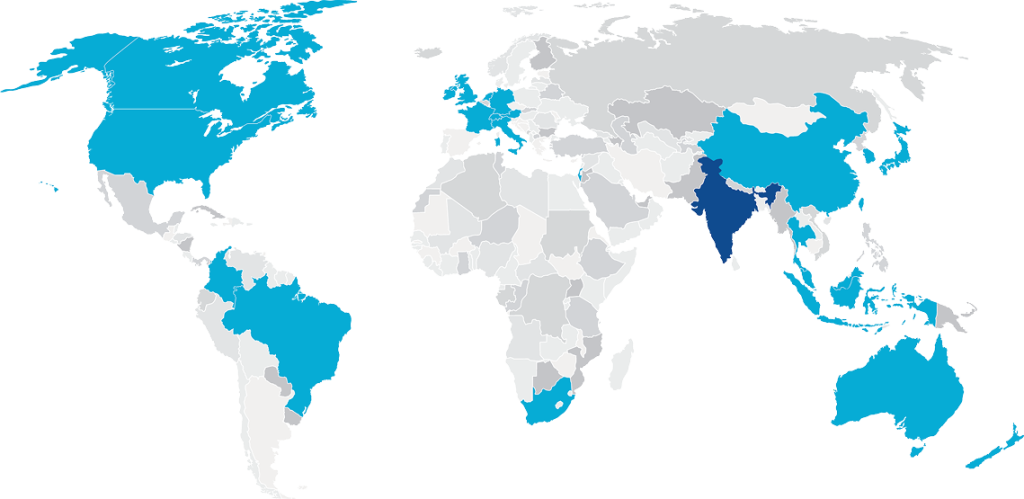

CFP® certification is the only globally recognized mark of professionalism for financial planning, setting the benchmark for expertise, ethics, and professionalism. 230,648 CFP® professionals worldwide are helping millions achieve their financial goals with confidence and clarity.

Key Benefits of CFP® Certification

The CERTIFIED FINANCIAL PLANNER® professional credential is the most desired and respected global certification for those

seeking to demonstrate their commitment to competent and ethical financial planning practice.

Enhanced Credibility and Trust as CFP® professionals are globally recognized, boosting client confidence and trust.

Career Growth and Success as you unlock new opportunities, enhance your earning potential, and build a thriving financial practice.

Comprehensive Financial Knowledge as you gain deep expertise to provide well-rounded, client-focused financial advice.

Global Recognition and Reach as CFP® certification is recognized in over 28 countries, enabling service to an international client base.

Competitive Edge & Advantage as demand rises for holistic financial planning, giving CFP® professionals an edge over other advisors.

Diverse Employment Opportunities in financial services, entrepreneurship, journalism, and many other fields.

Value of CFP® Certification

Public

Global research shows consumers who work with CERTIFIED FINANCIAL PLANNER® professionals have a better quality of life, enjoy more financial confidence and resilience, and are more satisfied with their financial situation.

Practitioners

The 2023 FPSB Value of Financial Planning Research global study shows that CFP® certification empowers working professionals to expand their client base and increase potential earnings, with many experiencing tangible growth within a year of certification.

Firms

Financial firms can better serve their clients, enhance their talent pipeline, and strengthen risk mitigation when they recruit and develop CFP® professionals.

How CFP® Professionals Are Impacting the Lives

of People in India

“Helping India Achieve Financial Well-Being.”

1

Helping in providing Trusted and Ethical Financial Guidance

2

Helping Turn Financial Goals and Dreams Into Reality

3

Helping in Building Financial Awareness for a Financially Stronger India

4

Helping in Empowering Lives With Financial Security

5

Helping People with Wealth Protection and Navigate Financial Risks and Challenges

Growing Global Network of CFP® Professionals

India saw remarkable growth in 2024, a 17.7% rise in CERTIFIED FINANCIAL PLANNER® professionals, making it one of the fastest-growing markets globally.

3,215 CFP®

Professionals in

India

Over 230,648 CFP®

Professionals

Globally

Helpful Resources

Strong Network of FPSB India

Education Providers

Partnered with leading education providers to deliver world-class financial planning education in support of CFP certification.

Institutions / Universities

Associated with top universities and institutions to integrate financial planning into academic curriculum and nurture future finance leaders.

Corporates

Explore our corporate partners for upskilling opportunities, career advancement, professional growth, and job enhancements.

Policy and Regulatory Ecosystem

Closely engaged with policymakers and regulators to shape a robust financial planning landscape aligned with global standards and ethical practices.

Students

Empowering aspiring students with knowledge, skills, and a globally recognized CFP® certification to build rewarding careers in Financial Planning.

Working Professionals

Join the strong network of CFP® professionals working across financial services in areas like wealth management, investment advisory, retirement planning, and estate planning.

Spotlight

FPSB India in News

Unlock Knowledge. Stay Ahead

All About Financial Planning Education

Your essential guide to building a secure financial future, developed by FPSB India, this eBook offers practical insights and foundational knowledge to help you make informed decisions and grow in your financial journey.

All About Financial Planning Education

Important Updates

India Specific tax planning textbook update

Revision in Examination Fee

India sees Strong Growth in Certified Financial Planner Professionals with 17.7% Increase; FPSB India Reports 3,215 CFP Professionals as of December 2024.

FPSB India Launches ‘Psychology in Practice’ Course to Equip Finance Professionals with Behavioural Finance Insights.

Update on Renewal fee for lapsed CFP Certification Fee in India – Effective from 1st Jan 2025

FPSB Exam Calendar-3 Months